Anne Paxton

January 2018—It was baseball’s Yogi Berra who said, with the unique slant that was his hallmark, “In theory there is no difference between theory and practice. In practice, there is.” More vividly, boxer Mike Tyson once summed up the same reality when asked to comment on an opponent’s strategy in an upcoming match: “Everybody has a plan—until they get hit.”

Laboratories may not have to fear such a sudden and traumatic hour of reckoning. But as new payment models change volume-based health care to value-based health care, these sports lessons are relevant to the laboratory industry’s strategic planning. If adding value, in theory, is becoming essential to laboratories’ survival, what does that mean they should do, in practical terms?

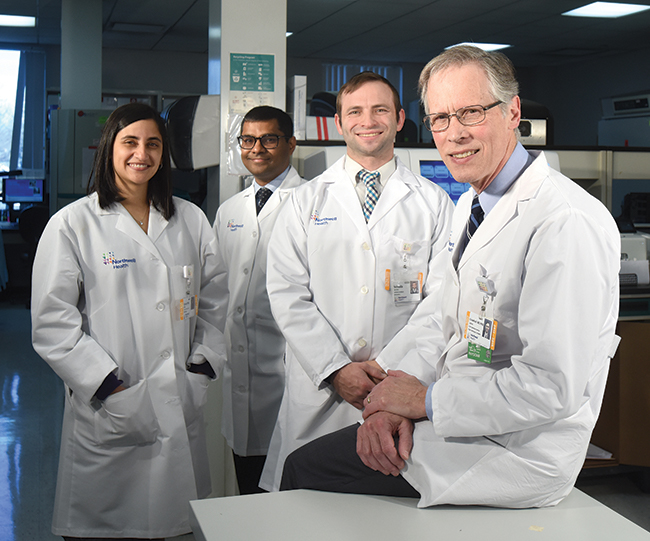

Dr. James Crawford (right) with (from left) Reeti Khare, PhD, assistant director of infectious disease diagnostics; Tarush Kothari, MD, MPH, physician informaticist; and Yehuda Jacobs, software architect. The question Dr. Crawford asks his laboratory colleagues is, “Can you demonstrate that patients are better for having received care from your lab as opposed to from other labs?”

To explore the next era for health care and what it means for labs, CEOs and directors from Geisinger Health, Henry Ford Health System, Northwell Health Laboratories, Kaiser Permanente North Laboratories, and TriCore Reference Laboratories began meeting in March 2016 as “Project Santa Fe.” They see their concept of Clinical Laboratory 2.0, emphasizing demonstration of how the laboratory adds value to patient care, as a critical clinical and business model for re-engineering laboratories’ role in the health care system.

“The value discussion has been underway for some years,” says founding member James Crawford, MD, PhD, senior vice president of laboratory services at Northwell Health in the greater New York metropolitan area. “Project Santa Fe was founded to bring together like-minded laboratory systems to drive the momentum of these initiatives.”

In 2017, Project Santa Fe shifted emphasis from visioning to practice by hosting a special session in May at the Executive War College and an open workshop in November in Albuquerque, NM, aiming to provide leaders from a range of laboratories, diagnostics manufacturers, and lab service companies a grounding in case studies and examples of innovative strategies that are working.

The workshop was meant to go beyond theoretical approaches, says founding Project Santa Fe member Michael Crossey, MD, PhD, chief medical officer at TriCore in Albuquerque. “It was very tactical and tangible. It gave actual examples of lab-initiated activities that can directly enhance patient care, whether through patient safety or efficiency.” Several participants in the workshop asked him for phone consultations afterward because “they literally want to get beyond the ‘idea’ level and into ‘how did you actually do that?’”

In interviews with CAP TODAY, organizers and first-time participants in the November workshop give their take on the Project Santa Fe mission and how some of the approaches that laboratories are pursuing are adding value within their institutions. Restructuring of ordering and results reporting, improving the speed and accuracy of the diagnostic sequence, harnessing population data, and establishing more direct links between pathologists and patients are emerging as some of the most promising avenues.

Dr. Hanson

For Curt Hanson, MD, chief medical officer of Mayo Medical Laboratories in Rochester, Minn., and chairman of the American Clinical Laboratory Association, the workshop was his first opportunity to participate in Project Santa Fe. He found it an intriguing and stimulating chance to meet with thought leaders and interact with other executives facing the need to reorient their labs to a value-based perspective.

As a practicing hematopathologist at Mayo in addition to his leadership role, Dr. Hanson considers it no surprise that clinicians don’t always order tests in efficient ways to get to a final diagnosis because they are burdened with having to know so much information about laboratory tests. In the meantime, he notes, the role of payers has become much more that of a gatekeeper.

“Historically, payers paid for services, but in today’s world what they really do is allow access to patients through their payment policies. They determine who can see which doctor and increasingly they are part of the picture of how patients receive care, whether we like it or not.”

TriCore’s added-value program, directly providing patients’ positive pregnancy results to payer-based care coordinators in addition to ordering providers, to channel these women into prenatal care, is a reflection of this new reality. “Early prenatal care drastically affects outcomes and cost of obstetrical care,” Dr. Crossey says.

One way that Mayo Medical Laboratories is trying to adapt and be proactive in ensuring the right testing is being done is by partnering with a clinical decision support company to offer a tool to help clinicians with test ordering. Having access to information that looks at the impact of lab tests on overall outcomes is difficult, Dr. Hanson says. But he is glad to see the push to add value gain traction in the lab community and hopes that the clinical decision support is a great first step. Mayo is engaged in several other projects to try to understand how labs can better influence outcomes, he adds.

Hay

Andy Hay, chief operating officer of Sysmex America, attended the workshop with a sense that action is urgently needed and the belief that Project Santa Fe is in the vanguard in addressing it. “There are some very big gaps between where the laboratory industry is as a whole and where we need to be to survive in the post-PAMA era,” Hay says, referring to the 2014 Protecting Access to Medicare Act, which will cut an estimated $670 million per year from Medicare lab reimbursement beginning this year.

Hay strongly agrees that labs need to show value in the care pathway rather than just produce diagnostic results, and Sysmex wants to make sure the services it provides are geared to Clinical Laboratory 2.0. But he doesn’t think hospitals and vendors in general have gotten with the program yet.

“There were maybe 50 hospitals represented at the workshop, probably fewer. That means roughly 5,250 hospitals in the country don’t know the train is leaving the station.” The future of vendors hinges on them too getting up to speed, he adds. If they don’t, then “the wheels are going to come off their business model. It’s no longer going to be sufficient to sell instruments. You’ve got to put a wrapper around them that demonstrates their value to the patient experience.”

From the perspective that the diagnostic companies are an integral part of the laboratory industry, Hay stresses that industry must interact with clinical caregivers in a way that integrates the lab in care decisions. Sysmex, he notes by way of example, is using teams of nurse practitioners to educate providers on advanced clinical hematology parameters, but has found adoption to be slow. “The savings potential generated by these parameters outside the lab will be huge, either through reducing pharmaceutical costs or length of stay. In a 2.0 world, innovations from the lab would be widely adopted and very quickly.”

The surging quantities of population data also may serve as a catalyst to speed the adoption of innovations from the lab, he adds, although health systems’ information technology systems will need to have enough horsepower to crunch the data. Still, “a lot of simple solutions would move the needle somewhat,” and can be shared, Hay believes. “If you have a new test that can shorten length of stay of a hip replacement, for example, it will work as well on the East Coast as on the West.”

Robert Michel, publisher of the Dark Report, who also participated in the Project Santa Fe workshop, notes that added pressure is coming not only from the continued decline of fee-for-service payment policies but from the changing dynamics of laboratories’ relationships with payers. “Labs are experiencing greater difficulties remaining in-network for health insurers in their region and finding it more difficult to have their claims settled promptly and fully.” Together, he says, those dynamics are creating “sustained financial pressure on all labs.”

Most hospital and health system laboratories, tasked with managing shrinking budgets and falling revenue from outreach services, “aren’t really looking that far in the future, and that’s a major reason why relatively few lab professionals are actively organizing added-value lab services in their organizations,” he notes.

But the stakes of reprioritizing are high and laboratories are in a good position to positively affect that process, Michel believes. When fee-for-service was king, pathologists were often hesitant to talk with a doctor about better utilization of tests because such conversations might have led the provider to switch lab referrals to a competing laboratory, he points out. “Now, a doctor may be getting a budgeted amount per month and will be graded or rated based on factors such as patient outcomes and overall cost per episode of care,” and thus will be open to having a clinical pathologist help them improve how they use lab tests.

CAP TODAY Pathology/Laboratory Medicine/Laboratory Management

CAP TODAY Pathology/Laboratory Medicine/Laboratory Management